What Do Expenses Include . What to include in a budget. Common types of expenses include employee benefits, depreciation, finance cost, administrative expenses, and operating expenses. Every business has expenses, and in some cases, these costs can be deducted from your taxable. A typical budget tracks your income and all variable and fixed expenses. An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made. Hence, expenses in accounting are the cost of doing business,. Expenses are the costs a business has to pay for to operate and make money. Expenses in accounting are the money spent or costs incurred by a business in an effort to generate revenue. Due to the accrual principle in accounting,.

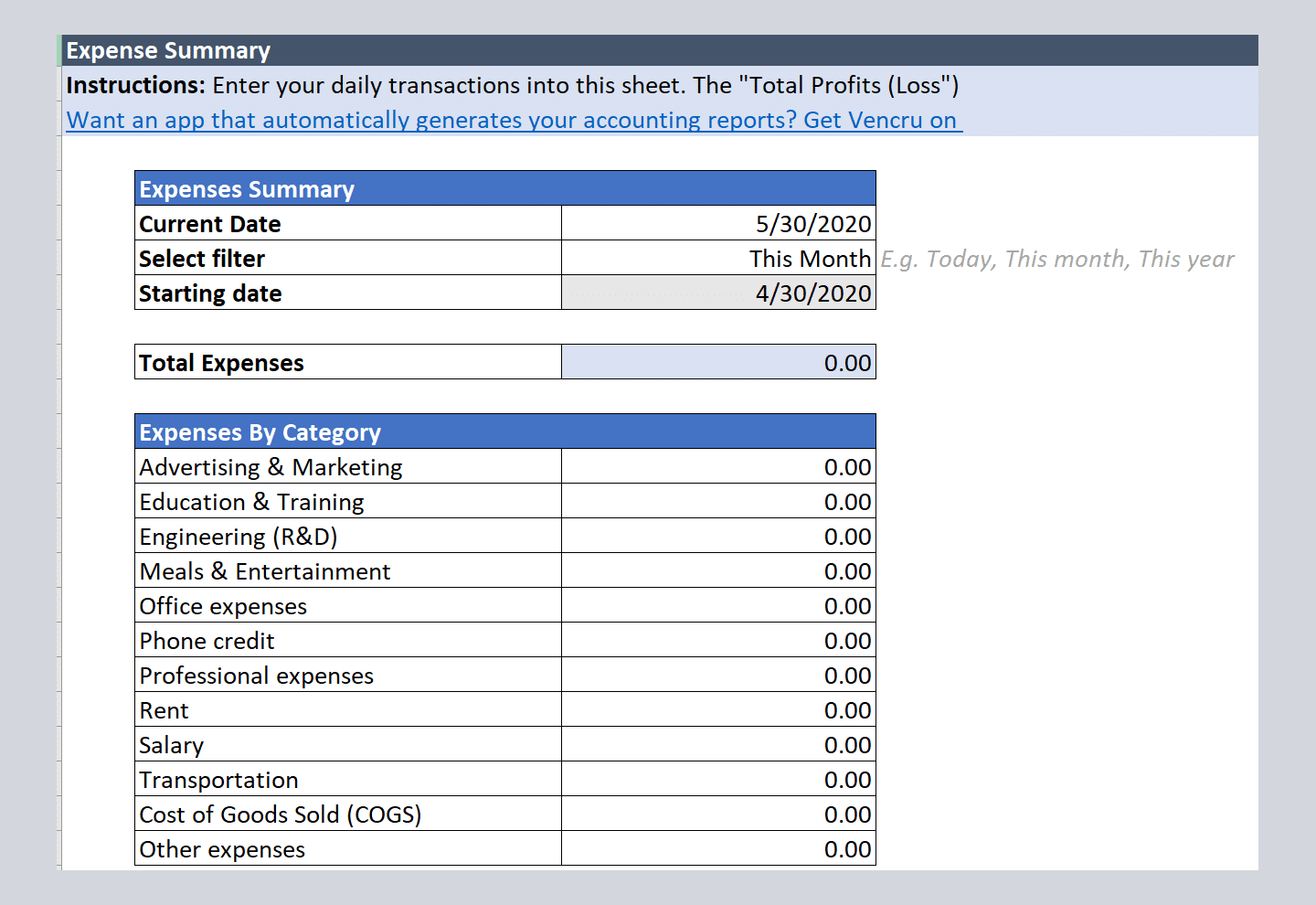

from www.vencru.com

Due to the accrual principle in accounting,. What to include in a budget. Common types of expenses include employee benefits, depreciation, finance cost, administrative expenses, and operating expenses. Expenses are the costs a business has to pay for to operate and make money. An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made. Hence, expenses in accounting are the cost of doing business,. An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. Expenses in accounting are the money spent or costs incurred by a business in an effort to generate revenue. A typical budget tracks your income and all variable and fixed expenses. Every business has expenses, and in some cases, these costs can be deducted from your taxable.

Free excel accounting templates and bookkeeping spreadsheet Vencru

What Do Expenses Include An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. A typical budget tracks your income and all variable and fixed expenses. Every business has expenses, and in some cases, these costs can be deducted from your taxable. Hence, expenses in accounting are the cost of doing business,. Expenses are the costs a business has to pay for to operate and make money. Due to the accrual principle in accounting,. Expenses in accounting are the money spent or costs incurred by a business in an effort to generate revenue. An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made. An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. Common types of expenses include employee benefits, depreciation, finance cost, administrative expenses, and operating expenses. What to include in a budget.

From www.pinterest.ca

How Much Money You Should Spend on Living Expenses Budgeting What Do Expenses Include A typical budget tracks your income and all variable and fixed expenses. Hence, expenses in accounting are the cost of doing business,. What to include in a budget. An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made. An expense is a type of expenditure that. What Do Expenses Include.

From maximizeminimalism.com

Simple, FREE Monthly Budget Planner & Expense Tracking Sheet (Excel) What Do Expenses Include Common types of expenses include employee benefits, depreciation, finance cost, administrative expenses, and operating expenses. An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. A typical budget tracks your income and all variable and fixed expenses. What to include in a budget. Expenses are the costs. What Do Expenses Include.

From www.pinterest.com

Selling, General and Administrative Expenses All You Need To Know What Do Expenses Include Every business has expenses, and in some cases, these costs can be deducted from your taxable. Common types of expenses include employee benefits, depreciation, finance cost, administrative expenses, and operating expenses. Expenses are the costs a business has to pay for to operate and make money. A typical budget tracks your income and all variable and fixed expenses. An expense. What Do Expenses Include.

From excelxo.com

And Expenditure Template For Small Business Expense Spreadsheet What Do Expenses Include An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. A typical budget tracks your income and all variable and fixed expenses. Hence, expenses in accounting are the cost of doing business,. What to include in a budget. Every business has expenses, and in some cases, these. What Do Expenses Include.

From exceltemplate.net

Household Expenses Excel Templates What Do Expenses Include Common types of expenses include employee benefits, depreciation, finance cost, administrative expenses, and operating expenses. Due to the accrual principle in accounting,. A typical budget tracks your income and all variable and fixed expenses. An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. Expenses are the. What Do Expenses Include.

From bookkeepers.com

How To Stick To A Budget 9 Ways To Keep Track Of Expenses What Do Expenses Include An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made. What to include in a budget. Every business has expenses, and in some cases, these costs can be deducted from your taxable. Hence, expenses in accounting are the cost of doing business,. Expenses in accounting are. What Do Expenses Include.

From corporatefinanceinstitute.com

Operating Expenses Overview, Example, Importance What Do Expenses Include An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made. An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. Due to the accrual principle in accounting,. A typical budget tracks your income. What Do Expenses Include.

From www.universalcpareview.com

What are general and administrative expenses? Universal CPA Review What Do Expenses Include Hence, expenses in accounting are the cost of doing business,. Expenses in accounting are the money spent or costs incurred by a business in an effort to generate revenue. Common types of expenses include employee benefits, depreciation, finance cost, administrative expenses, and operating expenses. A typical budget tracks your income and all variable and fixed expenses. Due to the accrual. What Do Expenses Include.

From www.vrogue.co

What Are Operating Expenses Definition Examples Tally vrogue.co What Do Expenses Include Expenses are the costs a business has to pay for to operate and make money. An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. Common types of expenses include employee benefits, depreciation, finance cost, administrative expenses, and operating expenses. Every business has expenses, and in some. What Do Expenses Include.

From www.youtube.com

List of Operating Expenses YouTube What Do Expenses Include Due to the accrual principle in accounting,. Common types of expenses include employee benefits, depreciation, finance cost, administrative expenses, and operating expenses. What to include in a budget. Expenses are the costs a business has to pay for to operate and make money. Hence, expenses in accounting are the cost of doing business,. A typical budget tracks your income and. What Do Expenses Include.

From tutorstips.com

What are Expenses its types and examples Tutor's Tips What Do Expenses Include Common types of expenses include employee benefits, depreciation, finance cost, administrative expenses, and operating expenses. An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made. What to include in a budget. Expenses in accounting are the money spent or costs incurred by a business in an. What Do Expenses Include.

From efinancemanagement.com

Operating Expenses Meaning, Importance And More What Do Expenses Include Due to the accrual principle in accounting,. An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. A typical budget tracks your income and all variable and fixed expenses. An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a. What Do Expenses Include.

From www.thestreet.com

What Are Operating Expenses? Definition, Calculation & Example TheStreet What Do Expenses Include An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made. A typical budget tracks your income and all variable and fixed expenses. An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. What. What Do Expenses Include.

From www.myaccountingcourse.com

What is Selling, General & Administrative Expense (SG&A)? Definition What Do Expenses Include Every business has expenses, and in some cases, these costs can be deducted from your taxable. Expenses are the costs a business has to pay for to operate and make money. An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made. A typical budget tracks your. What Do Expenses Include.

From www.educba.com

Operating Expense Formula Calculator (Examples with Excel Template) What Do Expenses Include Every business has expenses, and in some cases, these costs can be deducted from your taxable. Common types of expenses include employee benefits, depreciation, finance cost, administrative expenses, and operating expenses. Expenses are the costs a business has to pay for to operate and make money. A typical budget tracks your income and all variable and fixed expenses. An expense. What Do Expenses Include.

From www.wallstreetmojo.com

Travel Expenses Definition, Business Examples, Reimbursement What Do Expenses Include Hence, expenses in accounting are the cost of doing business,. Due to the accrual principle in accounting,. Every business has expenses, and in some cases, these costs can be deducted from your taxable. An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made. Expenses are the. What Do Expenses Include.

From corporatefinanceinstitute.com

Expenses Definition, Types, and Practical Examples What Do Expenses Include Every business has expenses, and in some cases, these costs can be deducted from your taxable. What to include in a budget. Expenses are the costs a business has to pay for to operate and make money. Common types of expenses include employee benefits, depreciation, finance cost, administrative expenses, and operating expenses. Due to the accrual principle in accounting,. An. What Do Expenses Include.

From finwise.edu.vn

List 96+ Pictures To Get A Picture Of A Business Overall Expenses Updated What Do Expenses Include Expenses are the costs a business has to pay for to operate and make money. Every business has expenses, and in some cases, these costs can be deducted from your taxable. Common types of expenses include employee benefits, depreciation, finance cost, administrative expenses, and operating expenses. A typical budget tracks your income and all variable and fixed expenses. Hence, expenses. What Do Expenses Include.